Mortgage & Financing Blog Articles (page 3)

Learn about Real Estate Financing

Five Options for Buyers Facing a Low Bank Appraisal

You’re on your way to buy a new home, congrats! You’ve found the one you love… your offer has been accepted… you’ve completed the inspection with little-to-no issues… you’re almost there, right? There’s just one more hurdle before you’re ready to sign on the dotted line and finance your home—the home appraisal. If you’re seeki

10 Easy Ways to Save Money

With back-to-school season in full swing, things like covering tuition costs and paying for extracurricular activities may be weighing high on your mind. Instead of worrying about all those extra fees, we have a few ways to help you save some money during back-to-school season and all year through. Here are 10 simple money-saving tasks that you can get started on today: Pack your lunch &ndas

Mortgage Matters - How to Choose One That is Right for You

When it comes to purchasing a new home, buyers are typically excited about choosing the options that are most important to them. Flooring, countertops and other fixtures may top their lists. But does that excitement carry over to a buyer’s home loan? Not always. When you apply for a mortgage, you may feel like your only options are approval or denial. But there are choices when it comes to

Five Things You Should Know About Homeowners Insurance

If you’re new to buying a home this summer, you’ve probably been advised that you’ll need to factor in the cost of homeowners insurance. While it is something you pay on a monthly basis, it typically is covered in your mortgage payment. For some homeowners, insurance can even be something that’s out of sight—and out of mind—until you need it most. Even vetera

Five Major Tax Breaks for Homeowners

From freely making simple design choices around the house to having something that is constantly accruing in value, there certainly are perks to being a homeowner year-round. But, spring brings particular good reason to appreciate homeownership. During tax season, homeowners can receive a little break from Uncle Sam in several areas. As tax day—which is April 17th this year—approach

Mortgage Matters: Five Ways to Get to a Quicker Close

When you’re waiting to move into a new home, a 30- or 60-day closing can feel like an eternity. While you can’t file your own mortgage paperwork, you can do some things to help speed up your closing. If you’re buying a home this spring, here are five ways you can get to the closing table a little quicker: 1. Get loan preapproval. Feel like you’ve heard this advice before

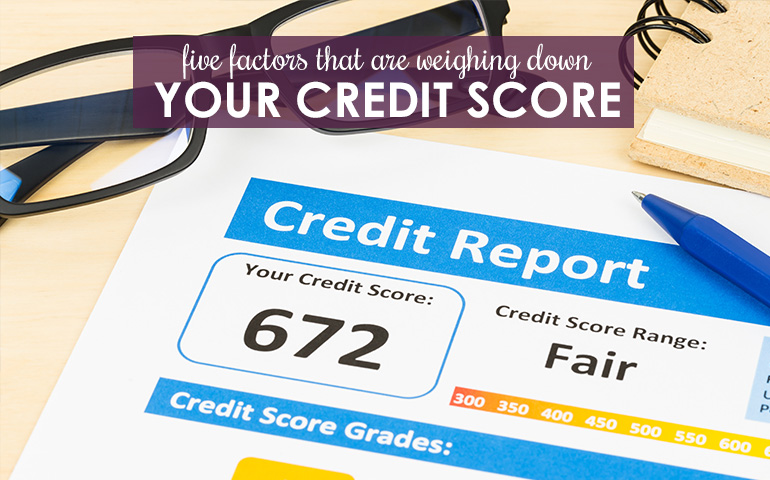

5 Factors Weighing Down Your Credit

If you’re in the market for a new home this year and you want to secure a great financing rate, you’re going to need to have a good credit score. But, how are you supposed to know if there is something casting a dark shadow on your credit? Of course, things like late or missed payments are going to negatively impact your credit score when you try to apply for home financing. However

10 Money Resolutions to Make Your 2018 Prosper

So far this year, you’re hitting the gym 2–3 times each week; you’ve even booked flights and made plans to travel more; now, it’s time to tackle that resolution to be more fiscally responsible. If buying a home is on your “to do” list in 2018, you’ll want to take your financial resolutions a bit more seriously in a hurry. Your financial picture plays a big

Don’t Be Confused. These Mortgage Misunderstandings Can Cost You

The spending season is upon us. But, that doesn’t mean you should be spending in excess everywhere you go. Just like you may be waiting for the best deals on those perfect holiday gifts, you also should be aiming for the best deal if you’re shopping for a home mortgage. Unfortunately, just like the flurry of holiday sales can have you confused about what price is best, a few mortgag

Want Seasonal Savings? Try These Five Tips to Avoid Overspending

Now that Thanksgiving is over, it’s time to shift mental gears to the impending holiday shopping season. With so many deals before the holidays arrive, it is incredibly easy to go spend crazy. But, what if you have financial goals like saving money or making a major purchase, you know, like buying a home, in the next year or so? What can you do to prevent yourself from splurging for the n